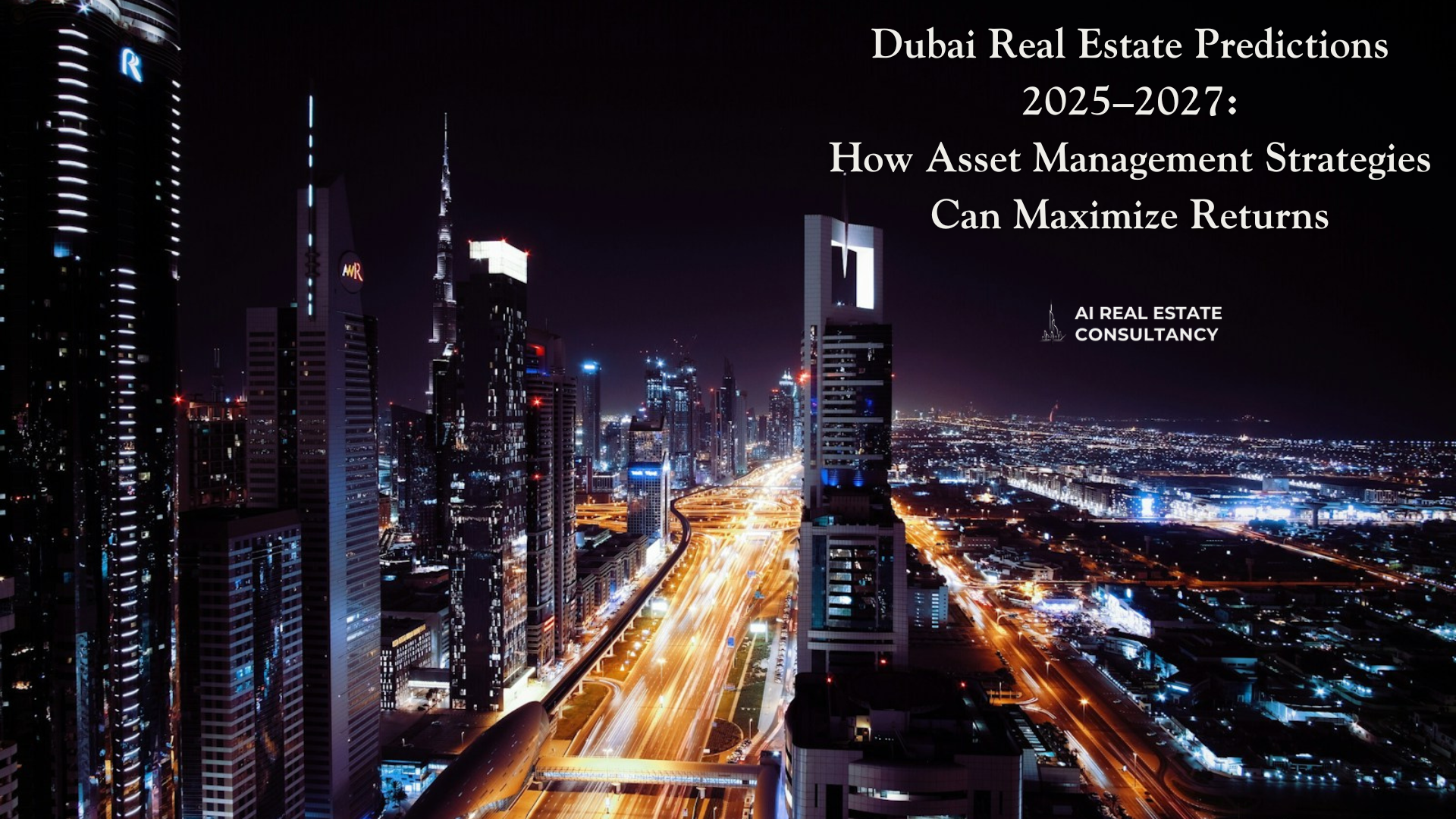

Our latest research provides a forward-looking analysis of Dubai’s real estate market from 2025 to 2027, leveraging AI-driven predictive analytics and comprehensive performance data from 2022–2024. By examining trends in ready apartment price appreciation, volatility, and community-level performance, we identify key opportunities for value creation and risk mitigation. This study highlights how strategic asset management can help investors navigate dynamic market conditions, optimize portfolio returns, and capitalize on emerging growth areas over the next three years.

Ready Apartments Performance Analysis 2022-2024

The below dashboard presents a comprehensive analysis of how ready apartment historic performance affected its future performance. We analyze if past performance is a predictor of future performance.

Low Performers

Bottom 30% of performers

High Performers

Top 30% of performers

Average Performers

Middle 40% of performers

Low Performers

High Performers

Average Performers

Community Returns Performance – Above vs. Below Average Returns

Below to Above Average Transition

of below-average communities in 2022–2023 improved to above average in 2023–2024

Above to Below Average Transition

of above-average communities in 2022–2023 declined to below average in 2023–2024

Distribution of Price Changes Across Communities

Steady Growth Range

Most common price appreciation range, indicating stable market growth

High Appreciation

Areas showing exceptional growth, suggesting high market demand

Price Corrections

Range of price corrections in areas with softening demand

Detailed Statistical Insights

Mean Annual Price Change

Ready apartments showed consistent double-digit price appreciation, highlighting opportunities for institutional portfolios to maximize returns in high-performing neighborhoods.

Market Volatility (Standard Deviation)

Volatility in ready apartment prices eased in 2023–2024, reflecting the Dubai market’s continued maturation.

Price Change Range

Performance Outliers – Community Trends

Insights into communities showing consistent performance patterns

Sustained High Performance

Sustained High Performance

Continued Underperformance

Continued Underperformance

How AI Real Estate Consultancy Enhances Your Investment Strategy

Comprehensive solutions designed to maximize your portfolio’s performance

Targeted Opportunity Identification

Our AI-driven predictive modeling identifies undervalued ready apartment assets poised for significant appreciation.

Optimized Capital Allocation

We continuously reassess market conditions to strategically reallocate assets, ensuring your portfolio remains positioned for growth.

Risk Mitigation and Diversification

By analyzing both macroeconomic trends and community-specific drivers, we minimize exposure to abrupt market shifts.

Real-Time Market Intelligence

Our proactive monitoring system delivers timely insights, enabling swift decisions that safeguard and enhance ROI.